A Complete Guide to ZATCA E-Invoicing in Saudi Arabia – Compliance, Deadlines & Integration

The E-Invoicing in Saudi Arabia initiative by ZATCA is transforming invoice compliance. With Phase 2 already in effect and deadlines extending until September 30, 2025, businesses must integrate their systems to avoid penalties.

In this ZATCA E-Invoicing Saudi Arabia Guide you will find everything you need to know about compliance requirements, integration steps, invoice formats, and key deadlines.

ZATCA E-Invoicing (Fatoorah) Overview

Electronic Invoicing in Saudi Arabia is the conversion of paper invoices and notes into electronic format, where there is an exchange happening between buyer and seller through E-Invoices.

Important Terms related with ZATCA E-Invoicing in SaudiArabia

Electronic E-Invoice in Saudi Arabia

An Electronic Invoice according to ZATCA in Saudi Arabia is a tax invoice generated through electronic format as required by the ZATCA Regulations. A paper invoice converted to electronic format by scanning, copying, or other means are not considered as an electronic invoice.

Tax Invoice in Saudi Arabia

An Invoice raised by a Business entity to another Business Entity containing all tax elements and other information as required by ZATCA is considered as a tax invoice

Simplified Tax Invoice in Saudi Arabia

An Invoice raised by a Business entity to a Consumer containing all tax elements and other information as required by ZATCA is considered as a tax invoice

Debit Notes and Credit Notes in ZATCA E-Invoicing

Debit Notes are issued by sellers to increase the value of invoices after the invoice is issued, and credit notes are issued by Sellers to decrease the value of invoice. Both uses the same format of invoice as issued.

E-Invoicing Solutions for ZATCA Compliance

E-invoicing Solutions are ERPs, Accounting Software, or Billing Tools used by taxpayers to issue invoices that comply with all the technical requirements issued by ZATCA related the E-Invoicing.

Flick Network is one the leading E-Invoicing Solutions used in Saudi Arabia for E-Invoicing acting as a middleware between ERPs and ZATCA Portal

Fatoorah Portal for E-Invoicing

Fatoorah portal is the portal provided by ZATCA through which Invoices, Debit Notes and Credit notes are communicated with ZATCA. Further, Fatoorah is also used to onboard the Solution Providers with the ZATCA Portal for communicating these documents.

Cryptographic Stamp Identifier (CSID) in E-Invoicing

A Cryptographic Stamp Identifier links the E-Invoicing Generation Solution (EGS) and a solution provider such as Flick for helping ZATCA to confirm seller’s identity and respective E-Invoicing Solution Unit.

UUID in ZATCA E-Invoicing

A UUID is a Unique ID

QR Code Requirements for ZATCA E-Invoicing

QR Code in accordance with ZATCA E-Invoicing laws are a matrix barcode, having a pattern of black and white squares that is readable by a QR Code reader, having the details are required by ZATCA based on applicable phase for taxpayers.

Hash Function in ZATCA E-Invoicing

A hash function is a function that maps data of any size to fixed-size values called hashes, which occupy minimal space.

Invoice Reference Number in ZATCA Regulations

Invoice reference number referrers unique number issued to identify each invoice issued by a E-Invoicing Solution in according to Article 53 of VAT of the VAT Implementation Regulations.

Introduction of E-Invoicing in Saudi Arabia

E-Invoicing in Saudi Arabia was introduced in 2 Phases;

- Phase 1: Required all Tax Payers to provide a QR Code containing the details such as Name of Seller, TIN Number, Amount, Tax Amount.

Implemented from: 4th December, 2021.

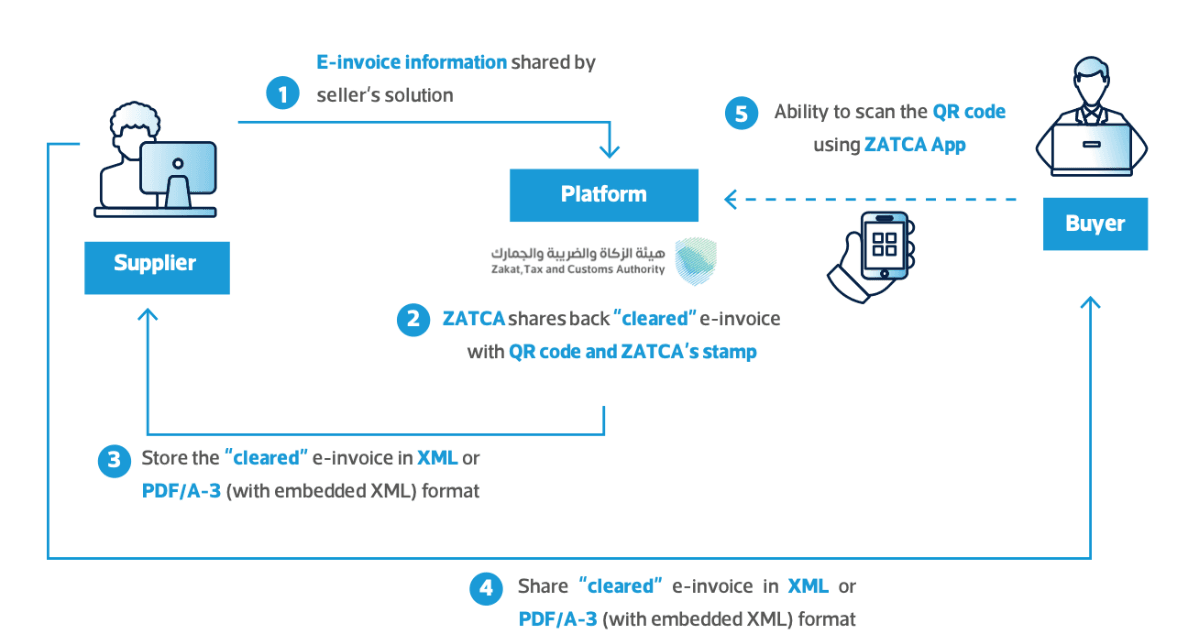

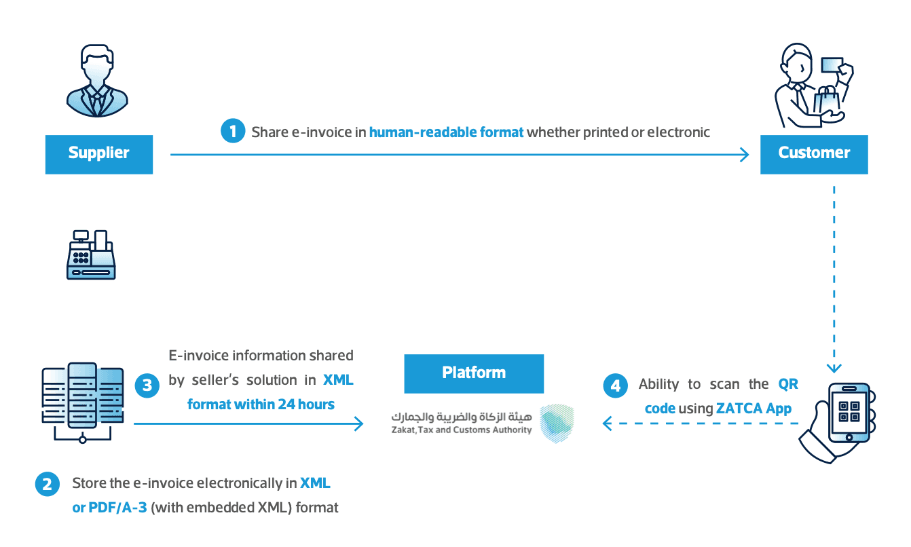

- Phase 2: Also called as Integration Phase, required by taxpayers based on annual turnover, with more additional reporting requirements, including generation PDF A/3 PDF with XML Embedded in PDFs and reporting of B2B and B2C invoices with ZATCA.

Implemented from: 1st January 2023. Introduced in waves based on turnover.

ZATCA E-Invoicing Phase 1 – Key Requirements

1. From 4th December 2021, the ZATCA announced a mandatory requirement for all taxpayers in Saudi Arabia to stop issuing manual invoices and made it compulsory to issue invoices by Electric means.

2. Required to use a compliant E-Invoicing Solution that follows all the requirements as issued by ZATCA inside its regulations and policies.

3. The E-Invoicing Solution should be able to Generate QR Code as required by ZATCA and should be able to restrict, any uncontrolled access, tampering of invoices and multiple invoice sequences.

4. Ensure Invoices Include additional fields as required by ZATCA.

Additional Fields Required in E-Invoicing Phase 1

1. Tax Invoices: The TIN Number of the buyer in addition to the invoice type and QR Code.

2. Simplified Tax Invoice: A Mandatory QR Code with all details as mentioned by ZATCA

ZATCA E-Invoicing Phase 2 – Compliance and Integration

1. E-Invoicing phase 2 was introduced in Saudi Arabia with a requirement to integrate taxpayer’s ERP/Accounting Software/ Billing Software to integrate with ZATCA and issuance of Electronic Invoices as required by ZATCA in XMLs or PDF A/3 Formats for human readable.

2. E-Invoicing phase 2 has been introduced as waves in Saudi Arabia, with the first wave for the largest taxpayer group being started on January 1st, 2023 for taxpayers with a turnover above 3 Billion SAR, and now reached 19th Wave for companies with a turnover of 1.75 Million SAR with deadline as 30th September 2025.

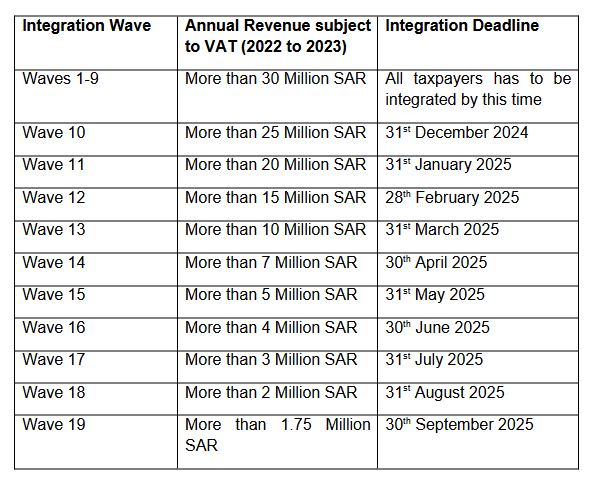

Integration Waves and Deadlines for E-Invoicing Phase 2

E-Invoicing phase 2 is launched in waves, with applicability based on turnover as;

Required Format for E-Invoices in Phase 2

ZATCA has required the taxpayers to issue invoices in XMLs or PDF A/3 Format with embedded XMLs inside.

What is meant by reporting in ZATCA E-Invoicing Phase 2?

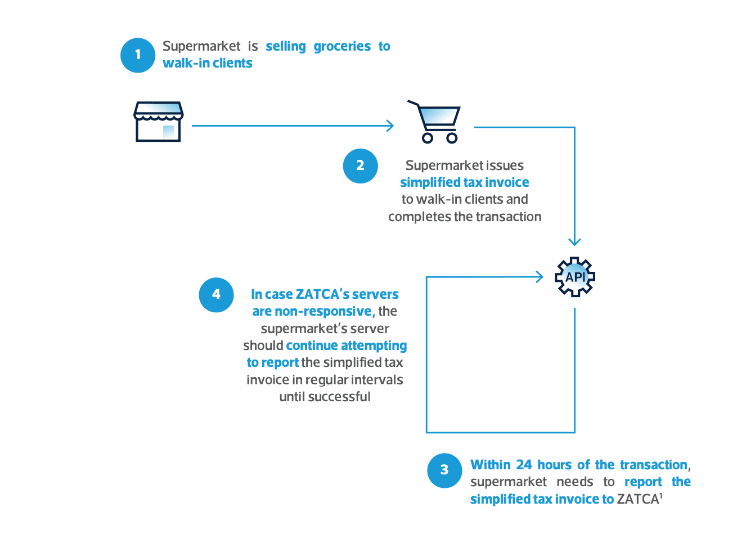

Reporting is applicable for B2C Transactions, where invoices and associated credit-debit notes are reported to ZATCA in near-real-time, which can go up to 24 Hours time. Once the invoices are reported, ZATCA does the validation and an acknowledgement is send back from ZATCA to the taxpayer through the APIs.

Impact of Advance Payments in ZATCA E-Invoicing Phase 2

The ZATCA law has required the necessity of issuing a tax invoice on receipt of advance against taxable supplies. Earlier, based on XML Perspective the value on which VAT was paid via advance amount can adjusted by subsequent invoice using tag <cbc:prepaidamount>. However, with recent requests from user, Zatca has introduced additional data fields in the Data Dictionary and XML implementation standards.

Advance Invoice Treatment in ZATCA E-Invoicing Phase 2

1. Invoice Code: Advance Invoices are issued with Invoice type code BT-3 with a fixed value of “386” and subsequent invoice with which advance is adjusted should have “388”.

2. Reference of Advance invoice on Subsequent Invoices: When there is an adjustment to be made on an invoice towards VAT paid earlier via Advance Payment Invoice, such adjustment can be made by providing the below data

- IRN (BT-1) of pre-payment invoice & UUID (KSA-1) of Advance invoice.

- Issue Date (BT-2) of the prepayment invoice

- Issue Date (BT-3) of the prepayment invoice

- The Invoice line document reference number “Prepayment document type (KSA-30) with a fixed value of “386”.

3. Adjusting VAT on Advance Invoices

For adjusting the taxable value, the registered taxpayer shall provide the amount under the tag <cbc:PrepaidAmount> (BT-113) as the Amount will be inclusive of VAT.

Taxpayers has to note that this field should be created only if the registered taxpayer has issued a separate invoice at the time of receiving payment in advance.

Once the field <cbc:PrepaidAmount> (BT-113) is created, then the above mentioned rules gets triggered asking the taxpayer to provide reference information (as explained above) and quantitative information as described below:

a. The adjustment has to be done by providing a single combined sum per VAT Category and per rate.

Suppose, if the Advance Payment was made with 7 line items having VAT Category Code “S” and “Z” then only 2 consolidated lines must be provided in the subsequent invoice(s) while adjusting the advance as one line for VAT Category Code “S” and another line for “Z”. This value has to be provided in Prepayment VAT category Taxable Amount (KSA-31).

b. Similarly, the VAT amount shall be provided for a specific VAT Category Code under Prepayment VAT Category Tax Amount (KSA-32) as the sum total of tax amounts subject to the specific VAT Category code of the prepayment invoice(s).

c. Each line should be compulsorily contain the VAT Category Code of the associated Prepayment invoice(s) under the prepayment VAT category code (KSA-33)

d. Each line should also include the VAT rate of the respective VAT Category code of the prepayment invoice(s) as the prepayment VAT rate (KSA-34).

Taxpayers should consider that this rate may also be 5% in case advance payment was received when the VAT Rate was 5%. This field will address the concerns about change in VAT Rates handling advance payment adjustments.

4. Verification of Advance Payment Adjustments

There is no real-time check between data of Advance Payment Invoice that is adjusted from subsequent invoices. However, such audits will be made on the backend as part of analytics and any mistakes may be further investigated by ZATCA resulting in the initiation of assessments.

There will be a minimum check on a real-time basis as below:

a. The Prepayment VAT Category Tax Amount (KSA-32) must be = Prepayment VAT category Taxable Amount (KSA-31) x Prepayment VAT rate (KSA-34) /100)

b. If a Pre-Paid amount (BT-113) is provided then the Pre-Paid amount (BT-113) must equal the sum total of the Prepayment VAT category Taxable Amount (KSA-31) and Prepayment VAT Category Tax Amount (KSA-32)

5. Rounding rules on advance payments:

The below-mentioned amounts related to the adjustment of advance payment must be rounded to two decimals:

a. Pre-paid amount (BT-113).

b. Prepayment VAT Category Taxable Amount (KSA-31)

c. Prepayment VAT Category Tax Amount (KSA-32).

Step-by-step Guide on ZATCA E-Invoicing Phase 2 Integration

Taxpayers, for whom ZATCA E-Invoicing Phase 2 is applicable shall follow the below steps;

Step 1: ZATCA Taxpayers shall login to ZATCA Portal using their credentials used for VAT and Zakat Filing.

Step 2: The taxpayer shall generate OTP Codes for Solutions to Integrate.

Step 3: The taxpayer shall use the OTP Code for onboarding the EGS

Step 4: The Taxpayer can review the Fatoora portal if EGS is Onboarded

Challenges in ZATCA E-Invoicing Phase 2 Integration

Based on our Experience handling 500+ Enterprise taxpayers for ZATCA E-Invoicing Phase 2 Integration, these are the few challenges we faced;

ERP Integration: Many Entities are having different Custom ERPs without much API functions making it hard to integrate Realtime integration with ZATCA Portal.

PDF A/3 Customisation: Many Entities are having complicated PDF Formats with additional fields that are required for their mandatory business functions, are making it difficult or asking for too much efforts to create a same copy of PDF A/3 as they already have.

VAT Reconciliation: Many Differences are identified during analysis of invoices reported and actual invoices to be reported, majorly due to errors, bugs or user mistakes while submitting invoices to ZATCA.

Flick being an Approved ZATCA E-Invoicing Solution Saudi arabia Provider has gone through these challenges multiple times and found solution that can help you to get complied for ZATCA E-invoicing Phase 2 within the deadlines provided.

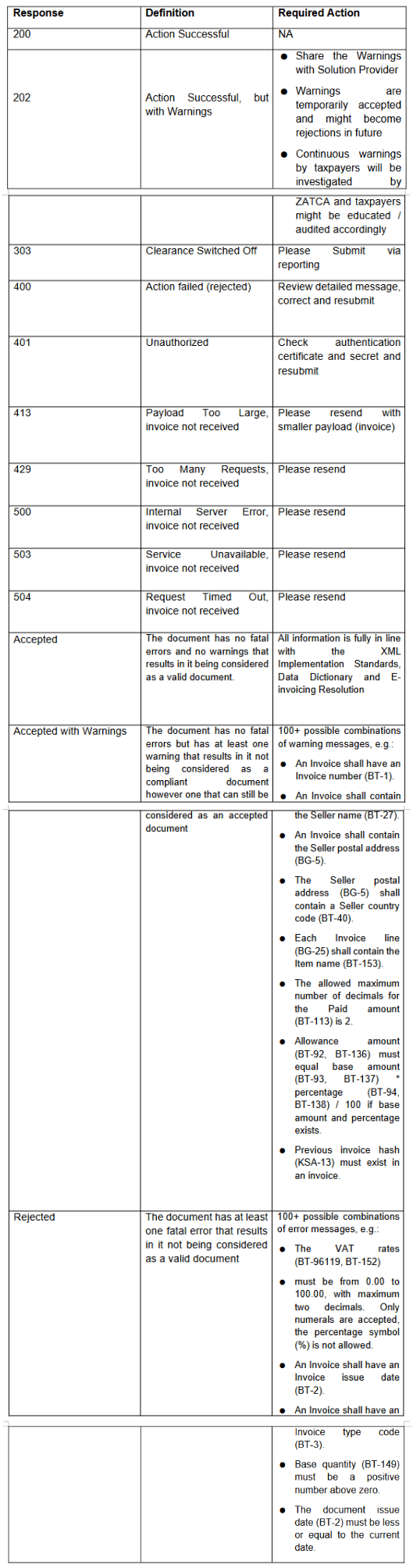

Different Scenarios related with Failed response from ZATCA with respect E-Invoicing Phase 2

Failure to obtain response from ZATCA on E-Invoicing Phase 2 – B2C

Tax payer on such instances shall keep evidence of try to clear the invoice.

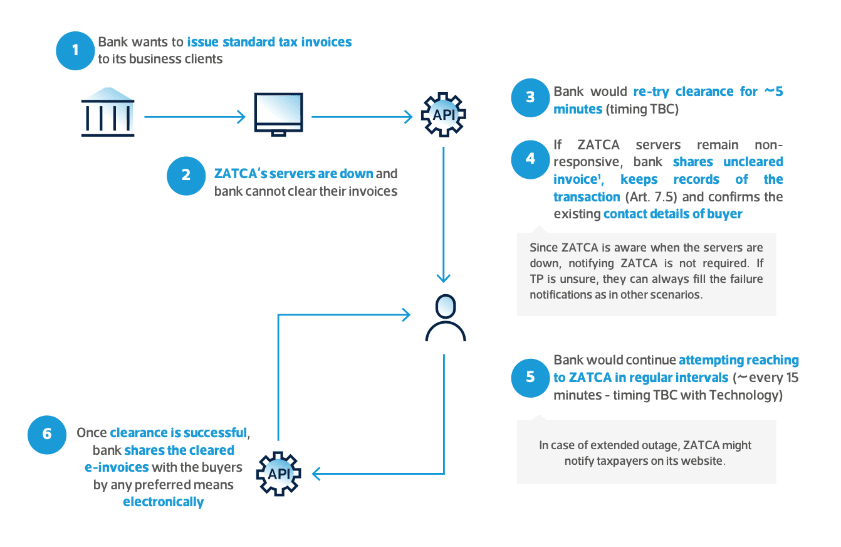

Failure to obtain response from ZATCA on E-Invoicing Phase 2 – B2B

The invoice shall be issued once the ZATCA Servers are back in production.

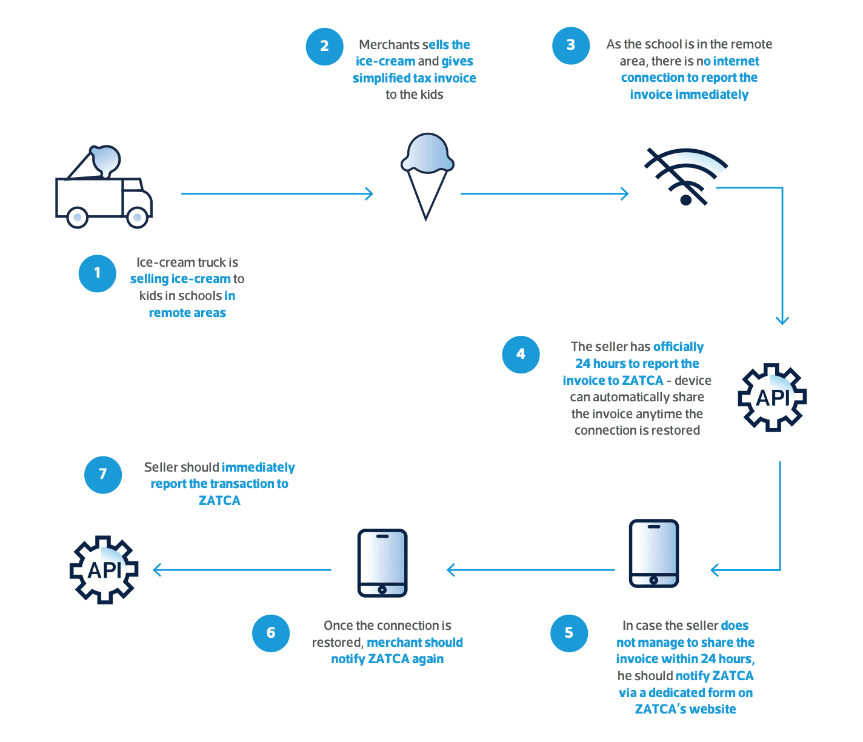

Failure to Submit E-Invoice to ZATCA – B2C

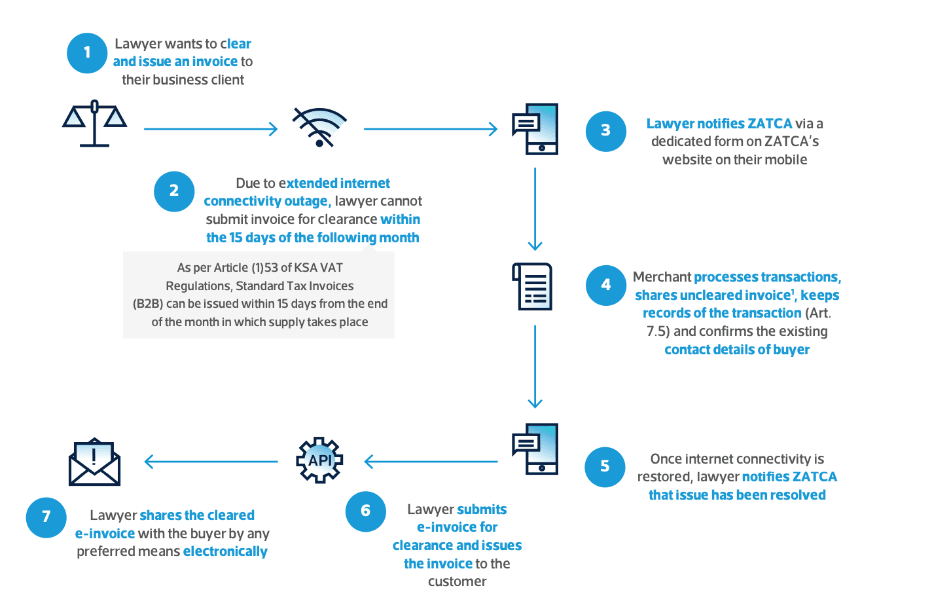

Failure to submit e-invoice to ZATCA -B2B scenario

The Invoice will be compliant only once the invoices are submitted to ZATCA after the connection is restored. Further, the tax payer shall keep evidence of trying to get complied

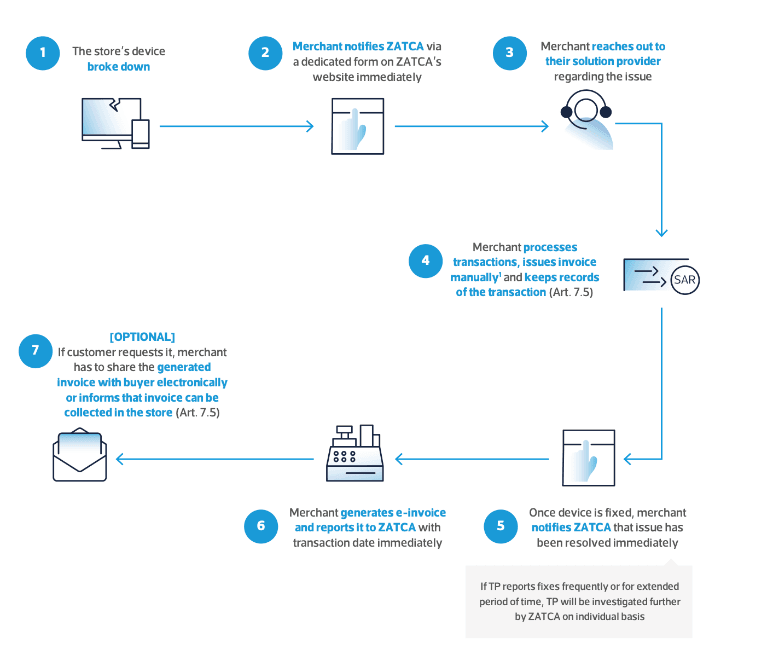

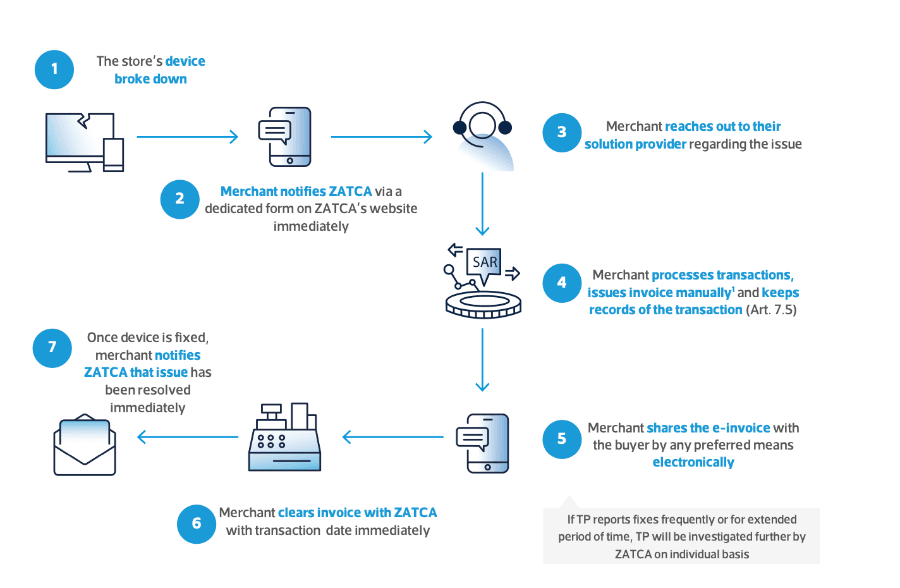

Treatment for Failed B2C E-Invoice Generation in ZATCA E-Invoicing Phase 2

The Invoice will be compliant only once the invoices are submitted to ZATCA after the connection is restored. Manual invoices will be not considered as E-Invoices.

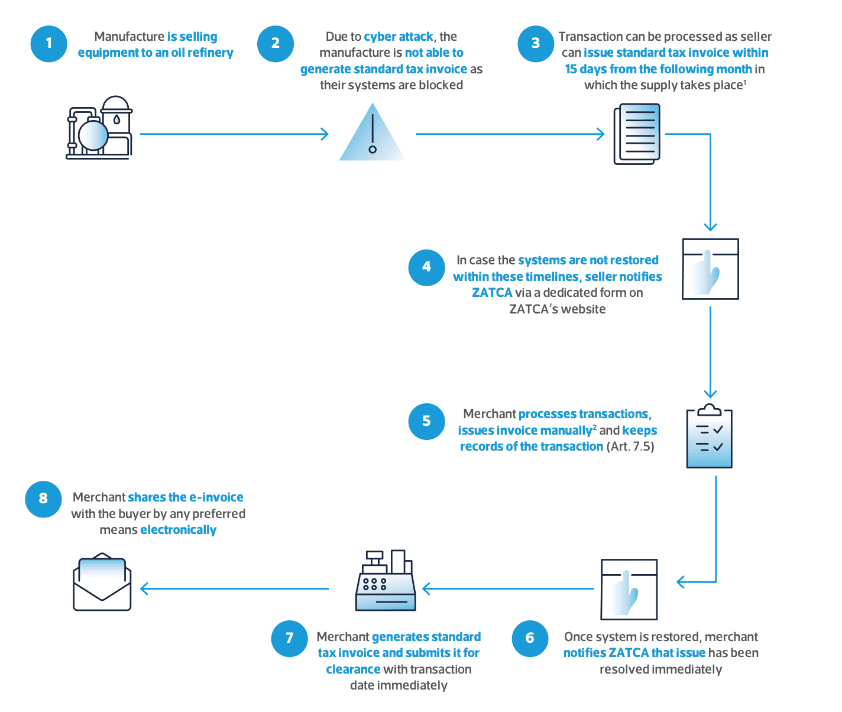

Treatment for Failed B2B E-Invoice Generation in ZATCA E-Invoicing Phase 2 (Non-Continuous Supply)

The Taxpayer can notify ZATCA within the end of Supply Month. The Invoice will be compliant only once the invoices are submitted to ZATCA after the connection is restored. Manual invoices will be not considered as E-Invoices.

Treatment for Failed B2B E-Invoice Generation in ZATCA E-Invoicing Phase 2 (Walk-in Customers or Continuous Supply)

The Invoice will be compliant only once the invoices are submitted to ZATCA after the connection is restored. Manual invoices will be not considered as E-Invoices.

Understanding Different ZATCA Responses in E-Invoicing Phase 2

FAQs

1. What is ZATCA E-Invoicing Phase 2, when does it take effect, and who must comply?

ZATCA E-Invoicing Phase 2, also called as the Integration phase, is part of the transition to E-Invoicing in Saudi Arabia. The subjective taxpayers must comply with Phase 2 requirements for the electronic invoices and E-Invoice Solutions, and the integration with ZATCA’s system.

Phase 2 is enforceable starting from January 1, 2023 and implemented in waves by targeted taxpayer groups based on annual turnover starting from January 1st, 2023 for taxpayers having a turnover above 3 Billion SAR. Taxpayers will be notified by ZATCA on the date of their integration at least 6 months in before the deadline

2. How will ZATCA Notify the taxpayers about the applicability of E-Invoicing Phase 2?

ZATCA will notify its taxpayers through official and SMS, regarding the applicability of E-Invoicing Phase 2.

3. Will a taxpayer need to follow the E-Invoicing Phase 1 requirements while they comply for E-Invoicing Phase 2?

Once the taxpayer gets complied for E-Invoicing Phase 2, they do not need to continue Phase 1 QR. However, until the phase 2 implementation is complete they have to issue invoices with phase 1 QR Code.

3. Can a taxpayer who are not compulsorily required to comply with ZATCA E-Invoicing Phase 2, can voluntarily start implementing ZATCA E-Invoicing Phase 2?

A taxpayer can voluntarily start ZATCA E-Invoicing Phase 2 Integration if they are getting applied based on waves published by ZATCA and their deadline has not been reached yet. However, a taxpayer cannot implement unless the wave is published under which their turnover reaches the listed bracket.

4. How can a taxpayer confirm that they have completed the E-Invoicing phase 2 Integration?

Taxpayers can login to the Fatoora Portal and cross-verify the list of EGS onboarded based on which we can make sure our integration is complete

5. If One VAT Registration has Multiple Devices to Issue invoices, Should we onboard each device separately?

Yes, it should be separately onboarded

6. What is the language to be used in the Invoice to be shared in ZATCA?

As per the Article 53, of VAT Regulations all details in an Invoice should be in Arabic other than the XML which has to be in English.

7. How to issue invoices to a company if they VAT Registration in Saudi Arabia with a foreign address?

In such cases, the taxpayer can use the foreign address to issue invoice against the register customer.

8. Can we issue a single credit note against multiple invoice? What is the treatment of credit notes, if it has to be adjusted against multiple invoices?

Yes, a single credit note can be issued against multiple invoices, however the IRN of all those invoices shall be provided in the credit note.

9. Is PDF A/3 Requirement a mandatory in ZATCA E-Invoicing Phase 2?

Yes, PDF A/3 is a mandatory requirement, is a Seller decides to send invoice to a customer in Human Readable Format while ensuring compliance with E-Invoicing in Saudi Arabia.

10. What is the maximum size allowed for an Invoice in ZATCA E-Invoicing Phase 2?

The maximum size of an invoice allowed by ZATCA for E-Invoicing phase 2 is 10 MB.

11. Can someone submit the same invoice twice through ZATCA E-Invoicing Phase 2 Portal?

No, however ZATCA won’t reject such duplicate invoices during submission.

Conclusion

This ZATCA E-Invoicing Saudi Arabia Guide provides complete insights into E-Invoicing in Saudi Arabia, including compliance requirements, integration steps, and key deadlines. With Phase 2 deadlines extending until September 30, 2025, businesses must integrate their systems to ensure compliance.

For a smooth transition, Flick Network offers a ZATCA-approved E-Invoicing Solution that automates invoice generation, ensures seamless integration, and simplifies compliance. Contact us today for seamless Saudi E-Invoicing Phase 2 compliance.